世界エネルギー推移統計

2024年世界エネルギーデータ、脱炭素化指標にアクセス

Enerdataのインタラクティブ・データ・ツールへようこそ。

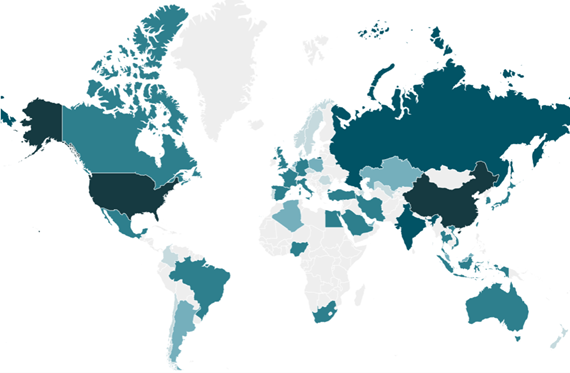

2024年の世界のエネルギーと気候のデータ、脱炭素化の主要指標にアクセスし、世界地図やグラフを閲覧してエネルギー産業の最新データとトレンドを探ることができます。

また、世界地図やグラフを閲覧して、エネルギー産業の最新データや動向を探ることができます:

- 包括的なデータアクセス: 石油、ガス、石炭、電力、再生可能エネルギーの生産、消費、取引に関するデータを、燃料燃焼によるCO2排出量とともにご覧いただけます。

- グローバルなカバレッジ: 1990年から2024年までの世界60カ国・地域のデータを網羅。

ユーザーフレンドリーな機能

- アニメーションによるデータの進化: 1990年から2024年までの時系列トレンドを視覚化。

- インタラクティブな地図: 拡大・縮小コントロールでエリアを簡単に選択。

- 国別ベンチマーク: 各国のデータを比較。

- 柔軟な期間選択: 任意の期間を選択してデータを表示。

- データのエクスポート: 世界全体または特定のエネルギー源別にデータをエクスポート。

最新のエネルギー・トレンドとデータの探索を開始し、一歩先を行く

世界脱炭素化指標

オレンジ色の数字:2024年のデータ

青色の数字:2023年のデータ

G20の統計および世界のその他の予測に基づく。

2024年の世界のエネルギー関連の主要数値

「世界エネルギー動向」(2025年版)は、重要なエネルギーデータに関する洞察を示しています。

当社は、これらの調査結果を長期的な気候目標に照らし合わせて考察しました。

- 2050年目標の達成に向けて、さらなる努力が求められる地域とは?

- 欧州がパリ協定の目標達成に苦戦している根本的な要因とは?

- 気候変動の緩和に大きく寄与している地域とは?

エネルギーの供給、需要、価格、ならびに温室効果ガス排出量(186か国)に関連した、この上なく包括的で最新なデータベースにアクセスしてください。

- 包括的

- 1990年以降の年間エネルギーおよびGHGデータ

- 年間最大2000以上の国別データシリーズと指標

- すべてのエネルギーについて 186カ国のカバレッジ

- エネルギー収支と統計に関する30年の経験